However, whether you’re considering attempting to sell today or maybe just getting place, your residence has actually really worth – and you will understanding how to use your house’s collateral just like the a tool on the complete financial technique is an essential part of think to suit your long-identity wants.

How does good HELOC works?

HELOCs can be useful economic gadgets, but it is crucial that you see what you happen to be signing up for. Fundamentally, an effective HELOC was an advance that enables you to borrow secured on new equity in your home to have a-flat day prior to typing a great fees months.

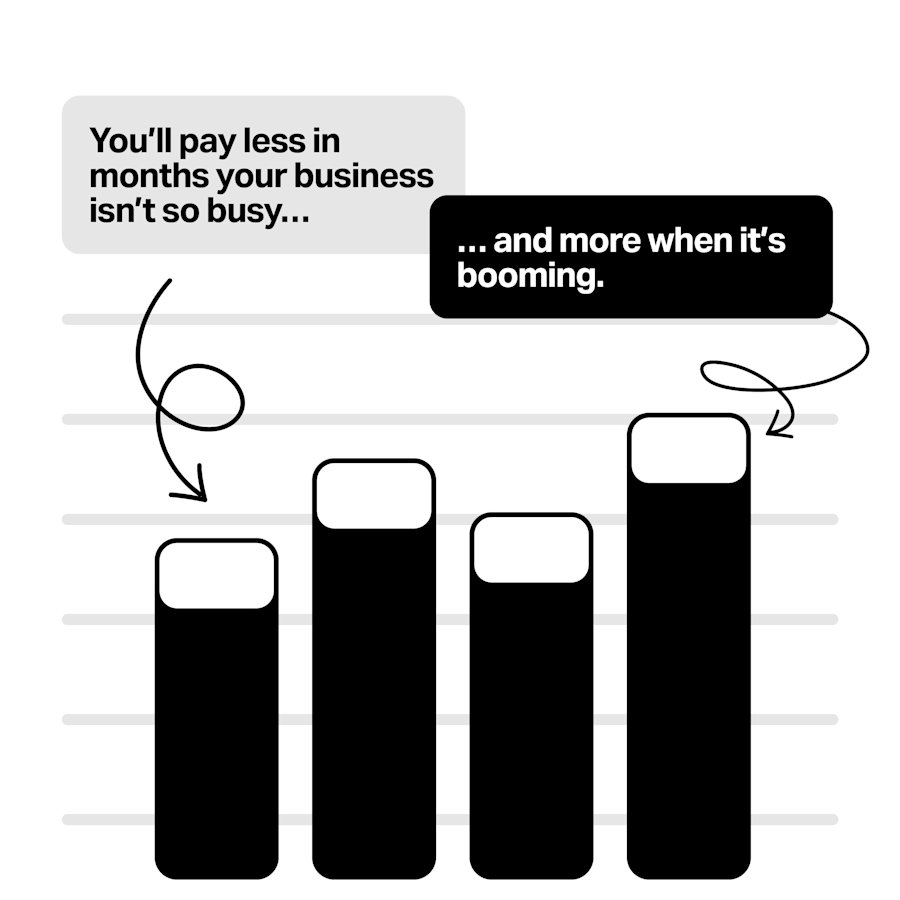

Into the borrowing period, you can borrow (draw) as much as just as much the brand new personal line of credit, spend it down, right after which obtain it once more. Month-to-month attention into outstanding balance flow from from inside the draw several months. Draw symptoms are different, but typically work with ranging from four and ten years.

During the payment months, you could potentially don’t draw. You will need to generate monthly payments to repay the fresh principal count your debt, in addition to appeal. The duration of installment periods may differ, because perform relevant pricing and you can charges.

Including playing cards, HELOCs enables you to constantly acquire to a certain amount facing their personal line of credit instead of taking right out a swelling contribution like you carry out along with other variety of finance. As opposed to credit cards, you simply can’t repay the balance and you may pay no focus just like the attention starts to your number you use whenever you mark finance within the draw period. But good HELOC try shielded by the security of your property and usually has a diminished price than simply credit cards, that is why HELOCs are always acquire huge numbers.

Just like any financing choice, it is critical to research your facts and you may talk to your banker before making people latest determinations, said Kim Quarrie, individual financing manager in the Wheaton Lender and Trust. Be sure to are aware of the brand new terminology, your financial attitude, and you can exacltly what the desires try. The best selection for your is just about to believe the individual state, and you’ll take care their banking partner is actually trying to find the financing option you to best fits your needs, lifestyle, and you may long-label plan.

Do’s: Ideas on how to make use of HELOCs

A great HELOC feels like an enormous credit card in that if We apply for $100,000, However keeps $100,000 available to myself, Ed Houlihan, elderly vice president out of individual lending on Beverly Lender and Trust, told me. As the I’m simply paying interest about what I am playing with, I will have fun with the fund, not one of finance, or a number of the loans. Yes, discover an annual fee connected, but i have the security of having those funds offered at my personal fingertips. Entry to the amount of money can be as straightforward as writing a good have a look at otherwise digitally going them to a checking account.

To own people seeking benefit from the home’s collateral for lots more tangible reasons, Quarrie says you are not alone. The best such as for instance in which we advice HELOCs is when the consumers come to all of us trying resource to have renovations, she told you.

Whenever mortgage rates is actually higher, HELOCs can be a wiser treatment for supply do-it-yourself finance given that refinancing prices are often negative. Additionally, using HELOC money for home improvements will make the attention you pay to your a great HELOC tax-deductible, however, please check with your accountant to make certain of the.

Almost every other well-known uses for HELOCs that Wintrust masters section people with the are education costs on their own or their students, otherwise because a supplement to their senior years propose to make certain ongoing entry to capital. Anybody else was preemptive borrowers, planning for problems or the unexpected, or money-created people whom explore an effective HELOC purchasing investment property otherwise start a business

Included in the long-identity steps, We have a tendency to tell people HELOCs try something you should consider now instead of purchase something that they might not you need instantaneously, Houlihan told you. That have one of those in your back pouch alternatively supply of funds to have something unforeseen or that you will be planning subsequently, the bucks is available instantly as they already prepared towards front.

Don’ts: What things to avoid with HELOCs

Remember, when you take out good HELOC, you will be credit resistant to the security in your home, and thus you might be with your family due to the fact collateral. If you don’t pay back, you risk foreclosures.

Compared to that end, the lenders say that relaxed expenditures aren’t an appropriate fool around with out-of HELOC funds, and you can indicates customers to utilize them alternatively included in a beneficial bigger financial means.

Across the same lines, customers arrive at our team looking to HELOCs to settle high-focus personal debt, such as consolidating playing cards. Although this might be an effective access to HELOC money, i suggest individuals not to ever discover the fresh credit cards throughout the installment to have risk of dropping to the same barriers and you can racking fees straight back right up.

Him/her for South Carolina express installment loans HELOCs, and much more

With the experienced regional cluster, we could bring the means to access a variety of high-really worth qualities and you may personalized alternatives for the financial, credit, and you may financial means, all in one place – as well as people who make it easier to exploit your own home’s growing value.