Rating all records in order so you can automate the method before you apply for a loan. Why don’t we talk about this new documentation you can constantly you prefer after you use for a home loan.

Evidence of Money

Your financial will request you to offer a number of files to guarantee your revenue. Specific records you may want to provide is:

- At least 2 yrs regarding government income tax forms

- Your own a few most recent W-2s and spend stubs

- 1099 versions or profit-and-loss statements if you find yourself worry about-functioning, or any other additional documents

- Divorce or separation decrees, youngster service conclusion and every other court documentation one verifies you to you are able to continue steadily to discover payments for at least another type of three years, if applicable

- Legal files one to proves you’ve been getting alimony, youngster assistance or any other brand of earnings for around 6 months, if the relevant

Borrowing from the bank Documentation

Your own lender have a tendency to charge a fee spoken or composed consent so you can glance at your credit score. They’ll look at your credit rating and appear to possess factors (such as for example a bankruptcy or property foreclosure) who does disqualify you against delivering financing. If you have a personal bankruptcy or property foreclosure in your borrowing declaration, you’ll have to waiting a few years before you happen to be eligible for home financing.

If you had an enthusiastic extenuating circumstance you to busted their borrowing, it is advisable to describe which toward bank that have proof. Instance, for folks who missed a number of payments on the credit cards because of a health emergency, you may want to bring your bank a duplicate of one’s scientific expense. This shows on financial your crappy scratches in your declaration was the result of a one-go out for example, rather than a pattern.

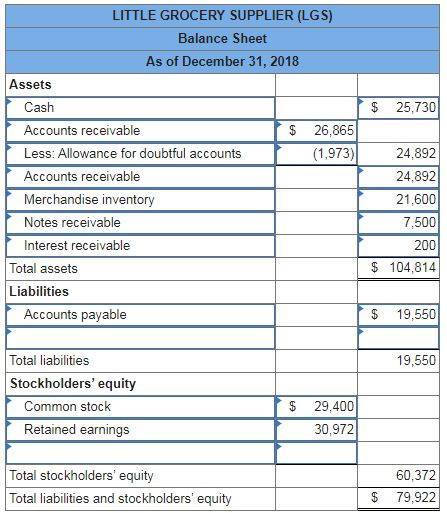

Proof of Property And you may Liabilities

- Doing 60 days’ value of membership statements that show the newest possessions on the checking and coupons membership

- The most up-to-date statement from the retirement otherwise resource account

- Records toward marketing of every property you have got rid of one which just used, such a copy of your term import for many who ended up selling a car or truck

- Proof and you can verification of every provide funds deposited into the membership over the last 8 weeks

Your lender may also cost you extra details about people costs you borrowed from, for example a student-based loan otherwise a car loan. Work along with your lender and supply people requested suggestions as soon as possible.

Getting A mortgage With Rocket Financial

Once you have all your files in order, it is time to initiate interested in financing. Some tips about what you can expect when you make an application for property loan that have Rocket Home loan .

Step one: Make an application for Financial Preapproval

Preapproval is the process of having the ability far a lender try happy to give for you. After you get a good preapproval, lenders have a look at your earnings, possessions and you will borrowing, and you may show exactly how much they may be able lend your. Might and dictate the rate of interest. A speedycashloan.net apply for parent plus loan good preapproval is different than just a beneficial prequalification. Prequalifications try reduced particular than just preapprovals because they do not need house verification. Ensure you get an excellent preapproval unlike an excellent prequalification.

Taking preapproved for a financial loan are a good idea since it will provide you with an exact idea of how much cash you can afford to pay on a home. This should help you narrow your home lookup, plus it makes you more appealing so you can both vendors and you may real estate professionals.

To begin with it is possible to manage once you sign up for preapproval was answer a few questions regarding your self, your income, the property and the house we should get. After that you can provide Rocket Home loan consent when deciding to take a review of your credit history. Your credit score are tabs on your credit background of people loan providers and you may loan providers you’ve borrowed out of in past times, along with credit card companies, banking companies, borrowing unions plus.