Do you realize you could potentially sign up for property collateral loan into a rental assets in Colorado which you own? Its a great way to control the significance you’ve centered more than many years of mortgage repayments. It is an economical treatment for and get a new, low-rate loan. Very, discover the guide to learn more about it.

Compiled by Winner Steffen

Winner Steffen was a seasoned Real estate professional and you can a house individual in main Tx having numerous years of sense as well as 130 product sales closed over the last 12 months.

Family Collateral Money

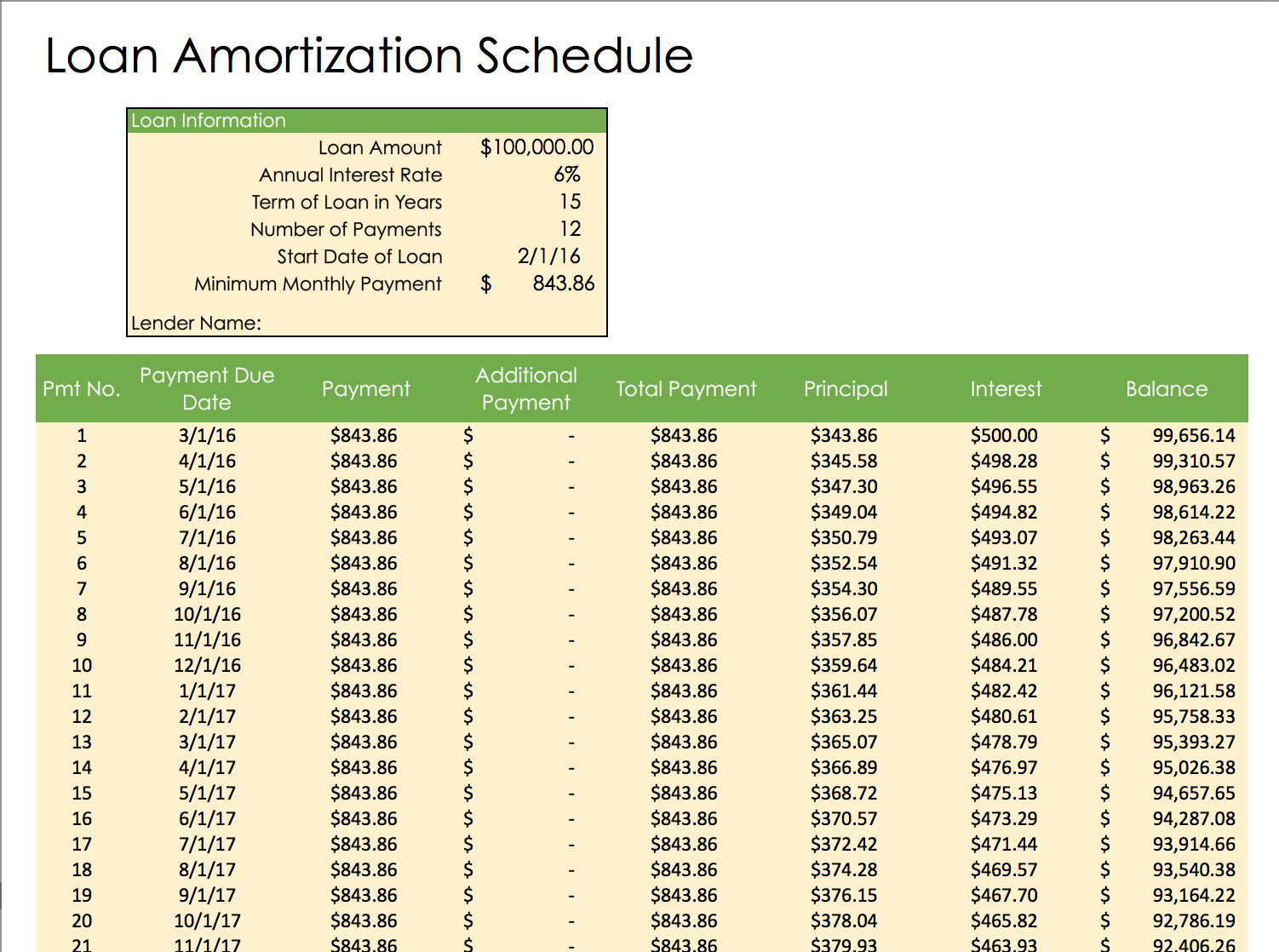

A house equity loan are a way to benefit from new worth of your property. Basically, your borrow secured on the overall property value your home, without the mortgage amount owed. Regarding family guarantee funds on the money functions within the Tx, you might borrow to 80% of overall value of the property in question. Nonetheless it can take certain lookin to track down lenders willing to grant a home equity financing toward a rental property. The capital you increase are used for subsequent expenditures or having intentions such as for example home upgrades otherwise debt consolidation reduction.

A house collateral mortgage differs from a property Collateral Distinct Credit (HELOC). A good HELOC is actually a personal line of credit that have a fixed otherwise variable price that is safeguarded contrary to the household itself or their collateral. Individuals can be withdraw funds from which credit line as much as a predetermined maximum, commonly known as a draw. On top of that, a home security financing is available in complete and will getting used depending on the borrower’s discretion.

When taking away house guarantee financing towards funding attributes for the Tx, it is vital to understand relevant laws. This type of legislation can assist you in believe and choosing the suitable time to have with the guarantee out of an investment property.

- Youre limited to a total of 80% of the property’s guarantee. As an instance, when your asset was respected within $200,000 and you have zero a great financial, you could potentially borrow to $160,000. Although not, for individuals who still have $60,000 a good, the maximum amount you can receive will be $100,000.

- Just remember that , you could potentially have only that equity loan at a time. If you would like obtain yet another financing, you ought to very first pay current that. Believe is vital, and we also can assist you along with your approach.

- In addition, youre permitted to take-out only one equity financing inside an excellent a dozen-day several months. Even if you features repaid the first mortgage, you cannot apply for a special equity mortgage up until 12 months keeps elapsed.

- Please note you to definitely financing can not be closed inside twelve days of implementing because of the first criteria of fact-examining. Financing approval usually takes at least thirty day period, however, we may cashadvanceamerica.net high risk loan manage to assist facilitate the method.

Its well worth bringing up that many lenders from inside the Colorado dont give domestic security financing to the capital characteristics because of the related top from risk. For that reason, it may be easier for you to borrow on the collateral of your own number one household, potentially securing a lower life expectancy interest along the way. Please e mail us to have suggestions about trying to find investor-friendly lenders who can help.

The 2% Code From inside the Texas

To possess property security mortgage to your a residential property in Tx, loan providers was restricted to recharging a total of dos% of one’s amount borrowed in charges. You should note that this won’t were fees related with:

- Studies

- Appraisals

- Headings

Lenders is actually forced to present an enthusiastic itemized selection of all the costs, situations, principal, and desire they shall be charging you on loan. Which must be done no afterwards as compared to go out till the closure. Given that borrower, you’ve got the directly to waive which requirement, you should provide composed agree.