To find a house can appear like an intricate process, especially if you is a primary-big date customer. To order a property isn’t as as simple seeking your ideal household for sale, creating a check, and you will relocating. No matter if sector things mean it is a customer’s business, it certainly is a good idea to seek information and go ahead cautiously. After all, to find a house is just one of the greatest opportunities might actually ever build. As a result of this prior to taking the latest leap into the very first household, you really need to take some time to examine multiple affairs, also exactly what your economic fitness looks like, how much you really can afford, and exactly how far you may have store having a down payment. Buying a house is a huge connection, however, eventually its a rewarding funding to suit your upcoming.

That being said, here are a few wise motions and info you need when you’re youre getting ready to purchase your earliest domestic.

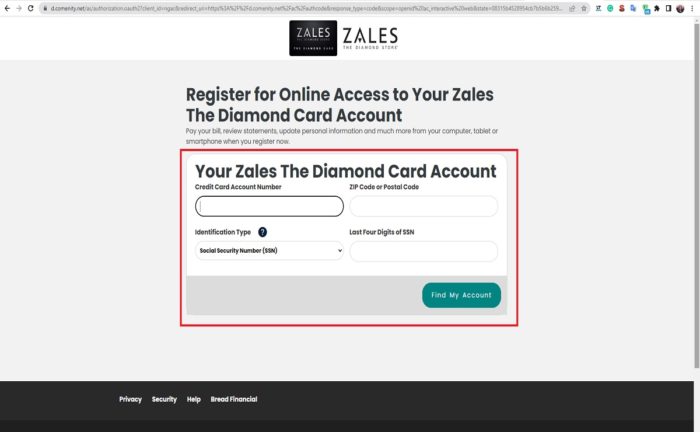

Once the an initial-date client, step one just take should be to check your newest credit score. Wearing an understanding of your credit report can not only help your alter your credit history throughout the years, it will also help you various other regions of existence. Lenders look at the credit score to aid see whether you can also be be eligible for a home loan and you will exactly what interest they are happy to offer you. If the credit score is on the low stop of one’s scale, the interest rate is higher, so that you will likely find yourself using alot more to the house fundamentally. A good credit score can help you safer a lowered interest and finally down home loan repayments.

Look at the credit reports along with three providers (Equifax, Experian, and you can TransUnion) observe your local area currently, and then you can start when planning on taking actions to change your own score.

2. Initiate Rescuing Very early

Mortgage off repayments may start from 5%, with some possibilities even giving no down payment. The newest 20% down-payment that you might usually listen to is the important minimal due to the fact around that count get bring an extra fee every month for the the type of Individual Financial Insurance policies (PMI). Loan providers fool around with PMI to guard on their own in the event you default with the the loan, however you’ll find earliest-go out homebuyer apps that basically bring both zero down payment and you may no PMI. Regardless, its important to features a little more on the savings in the addition toward deposit. The excess currency will allow you to buy another not-so-noticeable can cost you to help you homebuying, together with closing costs, appraisal charge, home inspections, swinging expenses, and you will unexpected home repairs and improvements.

step 3. Pay-off Small debts

To find a property is both a substantial financial commitment and you loans Luverne AL will an enthusiastic funding on your future. Their mortgage payment commonly impression all your family members plan for many years to help you been, but since your monthly obligations go right to your property mortgage, it’s possible to help you experience monetary positives in the future. When lenders think about your financial app, they look at the obligations-to-money (DTI) proportion to make certain you could potentially manage the loan repayments and ultimately pay off the loan.

Settling as often obligations as you are able to before applying getting home financing will assist change your credit history and reduce their DTI ratio, improving your possibility of being approved getting a mortgage loan having good rate.

4. Try not to Forget Preapproval

While it is appealing to help you diving straight into our house-google search processes, delivering a preapproval letter upfront lookin is vital. Home financing preapproval is actually proof of how much cash a lender try willing to financing one to get a property, and it outlines the particular regards to the borrowed funds. That have an effective preapproval in hand commonly alter your standing which have suppliers from the exhibiting all of them there are the amount of money accessible to generate the purchase which makes them more likely to accept the provide.

Additionally, you will have a far greater comprehension of simply how much household you might manage once you’ve a beneficial preapproval. This will help to stop you from dropping in love with good family away from your financial budget. Simultaneously, you may be less likely to want to find last-time waits or complications with your bank which will perception the capability to complete the get.

5. Work with a realtor

It could be tempting to help you leave working with an agent. Anyway, owner probably have their particular broker. But not, delivering an effective realtor provides a considerable virtue whenever home google search, especially for very first-time customers. Real estate professionals has an unparalleled knowledge of the brand new housing marketplace and will assist you in finding a home in your price range that fits all of your likes and dislikes.

Moreover, a realtor helps you negotiate the cost, closure words and you can walk you through the purchase processes. That it professional advice makes it possible to get a good deal than just you more than likely may have scored on your own.

6. Get a keen Inspector

To get property are an expensive procedure, out-of mortgage software charge to judge and you may closing costs. Very, why must you hand more multiple way more to have a home review?

A quality household examination makes you understand their prospective the latest residence’s big and you may minor items before buying they. It does make you conscious of exactly what can cost you, solutions, and you may maintenance our home requires instantaneously or in brand new near coming. A review can also determine potentially lifestyle-intimidating points eg shape and you may faulty wiring. On top of that, most lenders wanted a property examination is performed as part of the financing terms and conditions. This problem handles both you and the financial institution by making certain indeed there are not any major otherwise pricey issues that you may hamper what you can do to repay the borrowed funds. Providing a property check now offers your having a way to back outside of the give to order if you aren’t safe on inspector’s conclusions.

Buy your Very first House with People Earliest

Neighborhood Very first Borrowing from the bank Connection keeps a small grouping of lending professionals so you can make it easier to through the entire to purchase procedure from preapproval to closing. Know about the Basic-Go out Homebuyer System otherwise call us to begin with on your own real estate journey today!