Either class is cancel it Agreement by the notifying the other group on paper

Your website specifically forbids you against usage of any one of the facilities in just about any countries otherwise jurisdictions that don’t validate so you can the conditions and terms of them Terms of use. Your website is especially for pages regarding the region from India. In the event of one disagreement, either judicial or quasi-judicial, an equivalent would-be subject to new legislation from Asia, to your process of law within the Mumbai which have private jurisdiction.

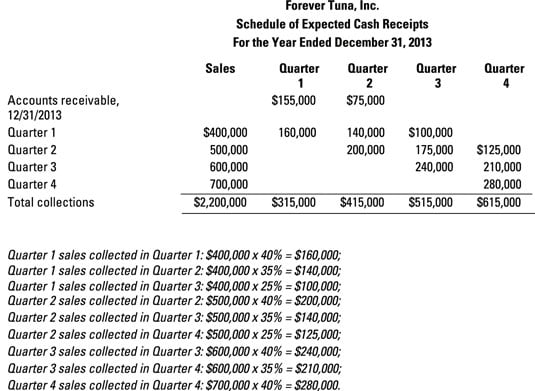

You are informed to read through the particular promote documents meticulously to possess addiitional information toward risk affairs, fine print before making people financial commitment in just about any design otherwise factors otherwise bonds or mortgage product

These types of Conditions and terms was ruled by and to become translated according to statutes out of India, instead of mention of the possibility or issues from legislation specifications of one legislation. You concur, in the eventuality of one conflict occurring about these Terms and conditions or one conflict developing when it comes to the new Site if for the price or tort or else, add on legislation of the courts located at Mumbai, India toward quality of the many including issues.