Advantages of USDA Mortgage brokers to have The police

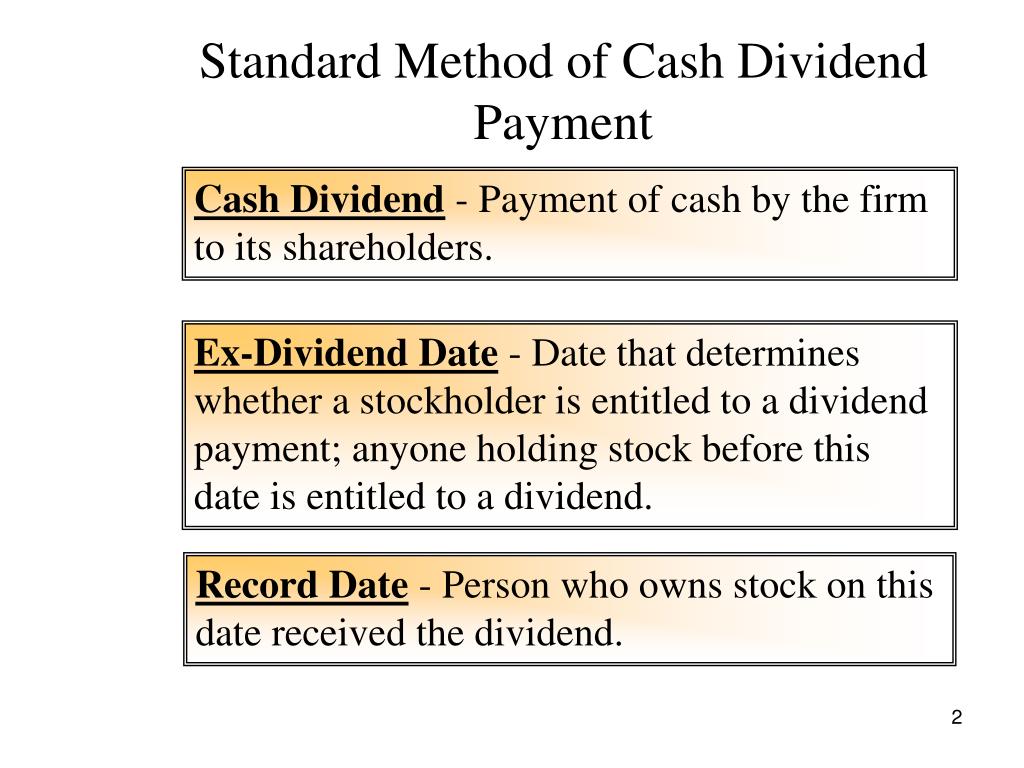

You can find type of mortgage brokers for law enforcement advantages nowadays. You will find financing to possess first-time home buyers, otherwise mortgages to get a property no money down. However, did you know that there clearly was a certain authorities-supported financing that requires no down payment, first time homebuyers can qualify for they, plus individuals with all the way down credit scores, that can be used across the the All of us? Its entitled good USDA Financial, and for the authorities, it’s the primary provider getting a home loan.

What exactly is an excellent USDA Home loan?

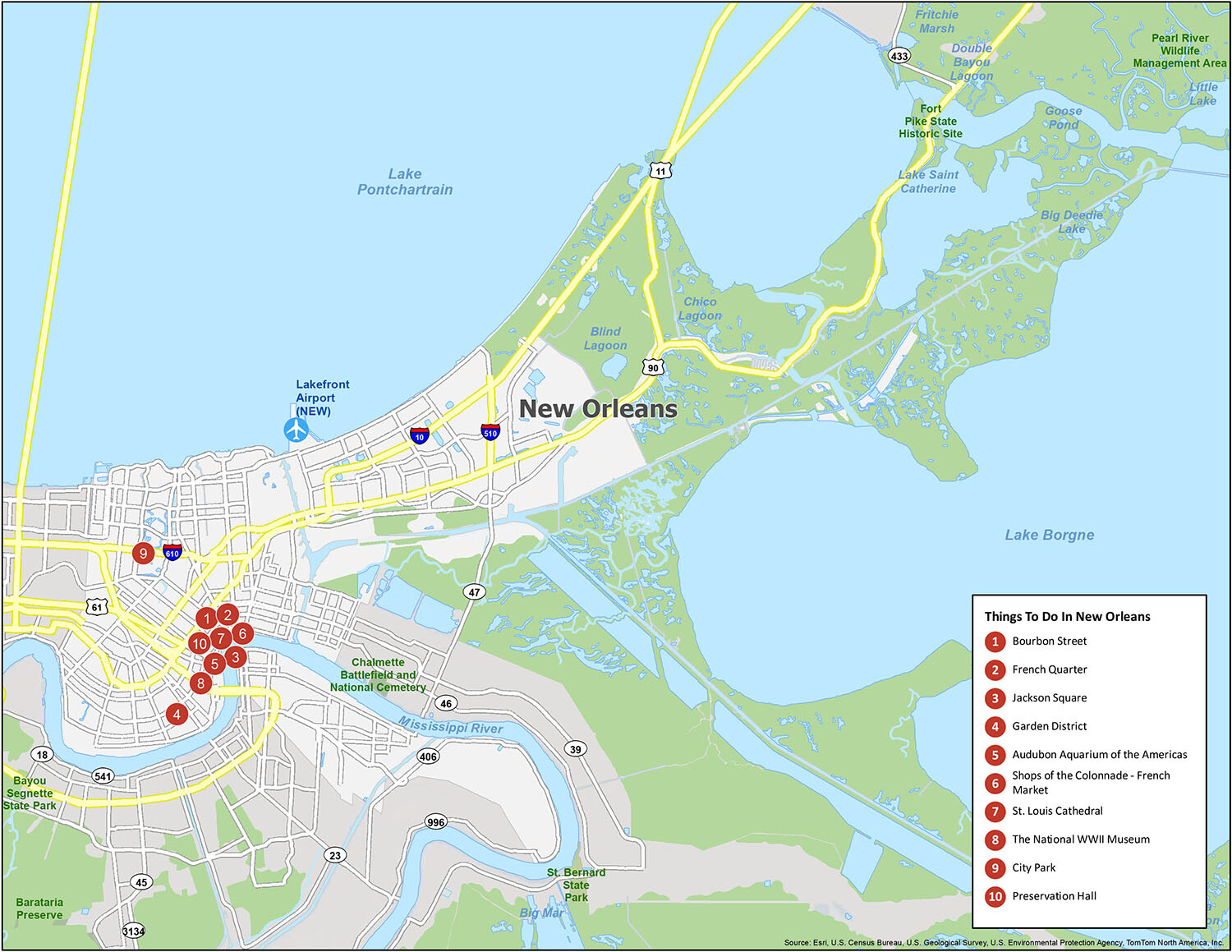

USDA funds is a selection for the authorities gurus or other applicants who want to purchase possessions within the rural section. These funds are supported, or covered, because of the You Service of Farming (USDA). The latest USDA talks of rural due to the fact an urban area having a population off lower than thirty five,000 somebody. Very, while you might consider country otherwise farm after you tune in to outlying, as much as 97% of your own You land is simply noticed outlying.

According to USDA, these types of mortgages support reasonable- and extremely-low-earnings people obtain pretty good, safe, and you can hygienic homes during the qualified outlying parts by giving commission guidelines… Essentially, USDA lenders support some body, otherwise a family, making reduced to modest income becoming qualified to receive homeownership. This can include first time homebuyers and additionally those who enjoys possessed property previously.