dos. Swinging from just one home loan equipment to another

Refinancing your mortgage is beneficial for the majority of explanations. However, knowing whenever, how as well as what prices helps you make better choice to your requirements.

From inside the label of the mortgage, it’s also possible to re-finance to get to know several personal and monetary needs. Refinancing will entirely change your latest home loan with a new mortgage giving your with a brand new label, rates and you will monthly payment. Refinancing will involve money and time, so make sure you talk to the bank concerning can cost you and you may benefits associated with securing an alternate loan.

You will purchase 3%-6% of your own loan dominating with the refinancing your own home loan. The full pricing to help you refinance might be dependent on the financial, your credit rating and your venue.

You could potentially refinance throughout your present bank or a separate lender. What exactly is primary is that the lender you decide on is actually reliable and provides aggressive costs and you will terms. How you can determine if you will be offered aggressive conditions is always to look around and you will contrast mortgage quotes off numerous lenders. All of our studies have shown that you might reduce average several thousand bucks along side life of the mortgage by getting extra rate rates.

step 1. Cutting your financial rates.

If the mortgage pricing are lower than when you finalized on the most recent financial, refinancing could reduce your monthly payments additionally the complete number of appeal you only pay over the longevity of the borrowed funds.

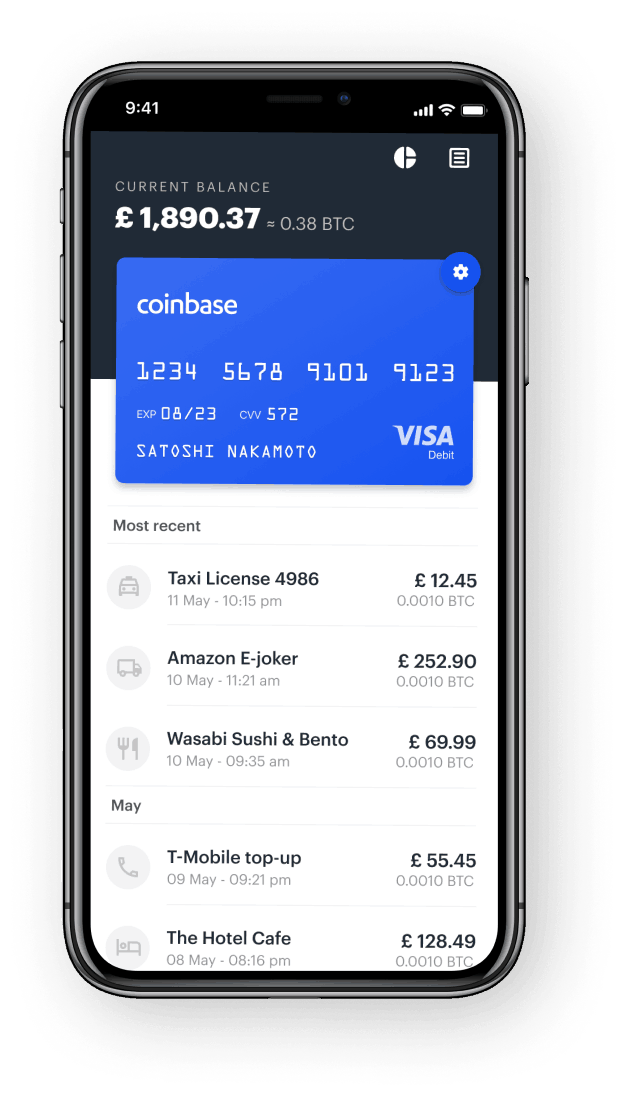

Probably the slight difference between the financial rates make a difference to your own payment per month. The following example reveals the latest buck matter variation when refinancing an effective $3 hundred,000 a fantastic loan balance into the a thirty-year fixed-price home loan loans in The Pinery without credit check from the individuals costs.