Everything you need to Understand USDA Loans When purchasing a good Home from inside the Northwest Arkansas

Once you think of the United states Agency off Agriculture (USDA), you probably think of food hygiene and chicken-handling bush checks. However, do you realize the latest USDA is also in the industry off mortgage brokers? Yep, the fresh USDA even offers as its purpose to assist group inside outlying areas become home owners in order to create good communities and greatest lifestyle. So they really provide home loans so you’re able to reasonable- so you’re able to reasonable-earnings group from the great prices with zero down-payment requisite. If you’d like to take advantage of this americash loans Pueblo West opportunity, here’s what you need to know on the USDA funds when selecting a house inside Northwest Arkansas.

Breakdown of USDA Loans

If you’re considering bringing an excellent USDA loan for buying a property for the Northwest Arkansas, then you will want to know what its and you will a small of your interesting background.

Good USDA mortgage are a federal government-supported, no money down home loan that have authorities-assisted home loan cost, so you can get lower cost than with the exact same authorities-supported applications such as for example FHA and you will Virtual assistant. Since the USDA funds don’t need a down payment, you can use only a small amount otherwise around you want to buy property so long as you to definitely residence is in the an effective rural,’ otherwise reduced densely populated, urban area.

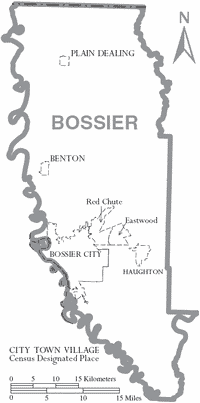

Today, rural doesn’t necessarily mean a farm or ranch way to avoid it from the center from no place. As an alternative, in this instance, [r]ural areas you will through the borders of town, a location with several farmland, or an area regarding a big city – very anyplace that’s not noticed metropolitan.’

USDA funds had the come from 1949 when property was a student in quick likewise have and you will lots of people was obligated to share home just after World war ii.